Customs

Bonded Warehouse Manufacture under Sec 65 of CA Revamped

·

Sec 65 a Good Substitute for EOU/SEZ

under Customs Oversight

·

Annexure A – Application for License

for a private bonded warehouse under section 58 and permission for manufacturing

and other operations under section 65 of the Customs Act 1962.

·

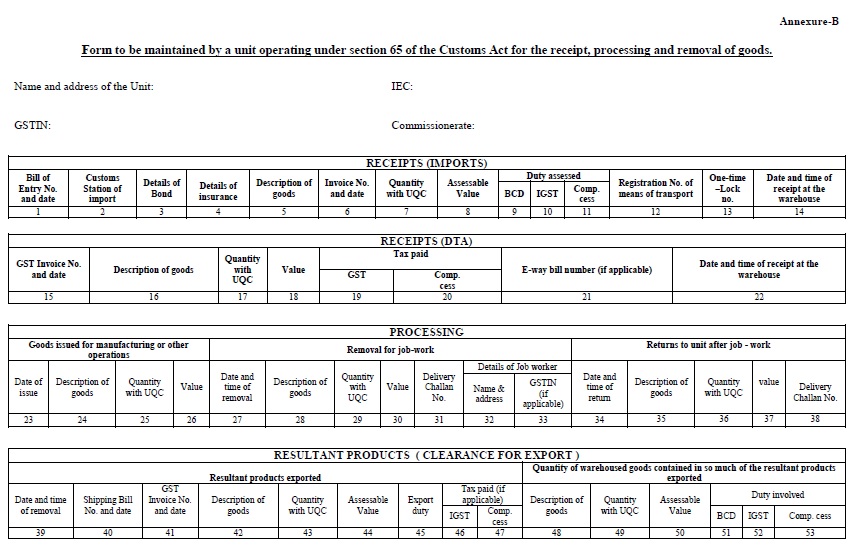

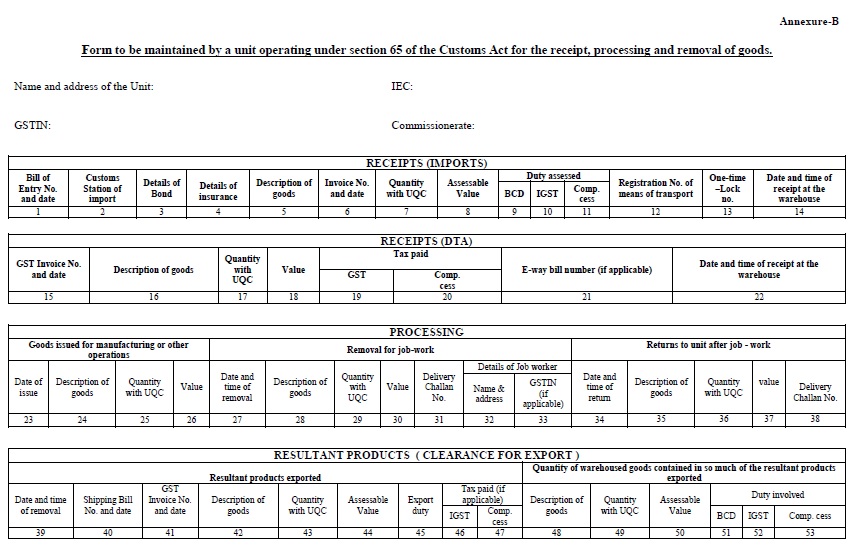

Annexure B – Form to be maintained by a unit operating under section 65 of

the Customs Act for the receipt, processing and removal of goods.

·

Annexure C – General Bond

[Circular No. 38/2018-Customs dated 18

October 2018]

Subject: Procedure to be followed in cases of

manufacturing or other operations undertaken in bonded warehouses under section

65 of the Customs Act.

Section

65 of the Customs Act, 1962 (hereinafter referred to as, “the Customs Act”)

provides for manufacturing as well as carrying out other operations in a bonded

warehouse.

2.

Under section 65, the Board has prescribed “Manufacture and Other Operations in

Warehouse Regulations, 1966” (MOOWR, 1966). These regulations provide for an

application seeking permission under section 65, conditions of the bond to be

executed by the licensee, maintenance of accounts, conduct of special audit and

cancellation / suspension of permission etc.

3.

While Regulation (3) provides for the data elements to be obtained from the

applicant seeking permission “to undertake any manufacturing process or other

operations”, no form has been prescribed. For the sake of uniformity, ease of

doing business and exercising due diligence in grant of permission under

section 65, the form of application to be filed by an applicant before the

jurisdictional Principal Commissioner / Commissioner of Customs is prescribed

as in Annexure A.

3.1

It is to be noted that an applicant desirous of manufacturing or carrying out other

operations in a bonded warehouse under section 65 read with MOOWR, 1966 must

also have the premises licensed as a private bonded warehouse under section 58

of the Customs Act. As part of ease of doing business and in order to avoid

duplication in the process of approvals, the form of application (Annexure A)

has been so designed that the process for seeking grant of license as a private

bonded warehouse as well as permission to carry out manufacturing or other

operations stands integrated into a single form. The warehouse in which section

65 permission is granted shall also be declared by the Licensee as the

principal/additional place of business for the purposes of GST.

4.

Post the Finance Act, 2016 effecting amendments to Chapter IX of the Customs

Act, 1962, the Warehouse (Custody and Handling of Goods) Regulations, 2016 were

notified on 14th May 2016 and Circular No. 25/2016-Cus dated 8th

June 2016 was issued, which collectively enjoins that licensees shall maintain

accounts of receipt and removal in prescribed formats in digital form and

furnish the same to the bond officer on monthly basis digitally. Therefore, a

licensee carrying out manufacturing or other operations in a bonded warehouse

under section 65 becomes obligated to maintain accounts as per MOOWR, 1966 and at

the same time also maintain records as private bonded warehouse. For the ease

of doing business, it has been decided that a licensee operating under section

65, shall not be required to maintain two sets of records. Henceforth, the

licensees manufacturing or carrying out other operations in a bonded warehouse

shall be required to maintain records as per the form prescribed under this

Circular (Annexure B), which combines data elements required under

MOOWR, 1966 and Warehouse (Custody and Handling of Goods) Regulations, 2016.

Sub-section (2) of Section 59 of the Customs Act requires the owner of the

warehoused goods to execute a triple duty bond for the warehoused goods. Such

bond shall be executed in the form prescribed under this Circular as per Annexure

C.

5.

To the extent that the resultant product manufactured or worked upon in a

bonded warehouse is exported, the licensee shall have to file a shipping bill

and follow the procedure prescribed under the Warehoused Goods (Removal)

Regulations 2016 for transport of goods from the warehouse to the customs

station of export. A GST invoice shall also be issued for such removal. In such

a case, no duty is required to be paid in respect of the imported goods

contained in the resultant product as per the provisions of section 69 of the

Customs Act.

6.

To the extent that the resultant product whether emerging out of manufacturing

or other operations in the warehouse) is cleared for domestic consumption, such

a transaction squarely falls within the ambit of “supply” under Section 7 of

the Central Goods and Service Tax Act,2017 (hereinafter referred to as the,

“CGST Act”). It would therefore be taxable in terms of section 9 of the CGST

Act, 2017 or section 5 of the Integrated Goods and Services Tax Act,

2017

depending upon the supply being intra-state or inter-state. The resultant

product will thus be supplied from the warehouse under the cover of GST invoice

on the payment of appropriate GST and compensation cess,

if any. As regards import duties payable on the imported goods contained in so

much of the resultant products are concerned, same shall be paid at the time of

supply of the resultant product from the warehouse for which the licensee shall

have to file an ex-bond Bill of entry and such transactions shall be duly

reflected in the accounts prescribed under Annexure B.

7.

For waste or refuse arising out of manufacture and other operations in relation

to the resultant products cleared for home consumption, import duty on the

quantity of the warehoused goods contained in such waste or refuse shall be

paid as per clause (b) to sub-section (2) of section 65.

8.

For waste or refuse arising out of manufacture and other operations in relation

to the resultant products cleared for export, where import duty on the waste or

refuse is paid as per proviso to clause (a) to sub-section (2) of section 65,

the same shall be deposited manually through a Challan. The records maintained

as per Annexure-B would be sufficient for accountal

of such goods.

9.

It may be noted that units operating under section 65 read with section 58 of

the Customs Act, are entitled to import capital goods, machinery, inputs etc.

by following the provisions under Ch IX. In so far as

domestic procurement is concerned, applicable rates of taxes shall be payable

and exemptions, if any, can also be availed. By virtue of simply being a unit

operating under section 65, they shall not be entitled to procure goods

domestically, without payment of taxes. The records in respect of such

domestically procured goods shall be indicated in the form for accounts

(Annexure B).

9.

Since the warehouse operating under section 65 also functions as a warehouse

licensed under section 58, the licensees can import goods and clear them as

such, under section 68 or section 69 of the Act, on payment of import duties,

along with interest as per sub-section (2) of section 61 of the Act. The

licensees shall also be required to maintain to submit monthly returns in “Form

B” as prescribed under Circular No. 25/2016-Cus dated 8th June 2016 for

such purposes.

10.

Clarification required, if any, may be sought from the Board

Annexure- A

Application for License for a private bonded warehouse under

section 58 and

permission for

manufacturing and

other operations under

section 65

of the Customs Act 1962.

Part I

1. Name

of the Applicant:

2. PAN No:

3. GSTIN:

4. IEC:

5. Constitution

of business (Tick as

applicable and attach copy)

(i) Proprietorship

(ii) Partnership

(iii) Limited Liability Partnership

(iv) Registered

Public Limited

Company

(v) Registered Private Limited Company

(vi)

Registered

Trust

(vii) Society/Cooperative society

(viii) Others (please specify)

Note:- Copy of certificate of incorporation along with Memorandum of Objects and Article of Association

in case of companies and partnership deed in case of partnership firms should

be attached.

6. Registered office:

Address:

Tel:

Fax:

E-mail:

7. Bank Account details: Name of

the Bank: Branch name:

Account

Number:

8. Name,

Address &

DIN (if applicable) : [of Proprietor/Partners/Directors etc.

(Please attach

copies of ID proof)].

9. Name & Designation of the Authorized Signatory: (Please attach copy of

Aadhaar Card as proof

of ID).

10. Details of existing manufacturing facilities in India and/or Overseas of the applicant firm and of

each of its directors/partners/proprietor, as the case may be (please attach separate sheet if required):

Part II

1. Address

of the proposed site or

building:

2. Boundaries of the warehouse:

(a)

North

(b) South

(c) West (d) East

3. Details

of property holding rights of the applicant (please provide supporting document):

(i) Owner

(ii)

Lease/rent

4. Contact details at the

site/premises:

Tel:

Fax

email

Website, if any

5. Details

of warehouse license issued

earlier to the applicant, if

any:

(i) Date of

issue of licence.

(ii)

Commissionerate file No.

(iii) Attach copy of warehouse license.

6. Whether the applicant is a Licensed Customs Broker?

If

yes, please provide details:

7. Whether the applicant is AEO?

If yes, please provide details.

8. Description of Premises:

(Please enclose a ground plan of the site / premises indicating all points of exit/entry/ area of storage /

area of manufacturing /

earmarked area of

office)

(i) What

is floor area?

(ii) Number of stories?

(iii) Total

area (or cubic capacity) available for storage?

(iv) Identify and mark

area(s),

occupied by third parties

in the ground plan:

(v) What

is the type of

construction

of walls and roof?

(vi) Which

year has

the building been

built? Has it been

recently remodeled? If so,

when? (vii) Identify by location

and size all accesses

to the site / building to pedestrian and

vehicles: (viii) Identify by location

and size all other accesses

to the building including doors &

windows:

(ix) Please indicate whether the premises have been authorized for commercial use by local

Government authorities?

9. Goods proposed to be manufactured or other operations proposed to be carried out (if necessary, additional sheets

may be attached)

|

FINAL PRODUCT |

||

|

Description

of resultant goods

out of manufacture or other

operations |

Classification

as Customs Tariff |

|

|

|

|

|

|

INTERMEDIATE PRODUCT |

||

|

Description

of goods |

Classification

as Customs Tariff |

|

|

|

|

|

|

GOODS PROPOSED TO

BE IMPORTED |

||

|

Description

of goods |

Classification

as Customs Tariff |

|

|

|

|

|

|

GOODS PROPOSED TO

BE DOMESTICALLY PROCURED |

||

|

Description

of goods |

HSN Classification |

|

|

|

|

|

|

DETAILS OF WASTE & SCRAP |

||

|

Description |

Classification

as Customs Tariff |

Briefly detail, input- out

ratio and attach any

supporting publication

/document, if available. |

|

|

|

|

In case of any change in the nature of operations subsequent to the grant of permission, the same

shall be informed to the jurisdictional Commissioner

of Customs within 15 days.

10. SECURITY FACILITIES AT THE PREMISES, EXISTING OR

PROPOSED:

(i)

Burglar Alarm System:

(ii) CCTV Facility:

a. Is there a CCTV monitoring system

installed to cover the surrounding

area of the site

and storage area?

b. Please indicate

the no. of cameras

installed:

c. No. of hours/days of recording accessible at

any

point of time:

(iii) Security Personnel:

a. Details

of arrangements

for

round the clock security provided for the warehouse:

b. Name & details

of firm contracted for security services:

c. No.

of personnel to

be deployed

on each

shift for round the clock security:

(iv)

Fire

Security:

(Please enclose a

fire safety audit certificate

issued by a qualified independent

agency)

11. DECLARATION:

We are a registered

or incorporated entity in India.

1. I/We undertake to comply with such terms & conditions as may be specified by the

Principal Commissioner of Customs or the

Commissioner of Customs.

2. I

/ We have not been

declared insolvent or bankrupt by a court or

tribunal.

3. I/We have not been convicted

for an offence under any law.

4. I/We

have

neither been

penalized

or convicted nor are being

prosecuted for an

offence under the Customs Act, 1962 or Central Excise Act, 1944 or Finance Act, 1994

or Central Goods and Services Tax Act,2017 or Integrated Goods and Services Tax Act,2017

or Goods and Services Tax (Compensation

to States) Act,2017.

5. There is no bankruptcy or criminal

proceedings pending against me /

us.

6. We hereby declare that the information

given in this application form is true, correct

and

complete in every respect and that I

am

authorized to sign on behalf of the

Licensee. I further undertake that if any particulars declared by me/us are proved to

be false, the licence

granted to me/us shall be

liable to be

cancelled and I/we

shall be liable for action under

Customs

Act, 1962.

(Signature of the

applicant/authorized signatory) Stamp

Date:

Place:

Part III

(For Use by Customs

Only)

1. Verification

of the applicant:

[Result of reference made for verification

of Declaration

at

serial no. 11 of Part -1I of the application) (verification to be conducted from DRI / DGGI; grant of licence may not be held

up pending verification)]

2. Date

of visit to the premises by the bond officer:

3. Findings of the bond officer

with

respect to

security, fire protection, IT enabled inventory management system, type of construction,

area

available for examination of goods, if required etc.

4. Is

the Premises

recommended for

issue of license as a warehouse / permission

to manufacture

or other operation under Bond?

Signature:

Name:

Designation:

Date:

Part IV

(For use by Customs

Only)

1. Details of

Warehouse keeper

appointed by the Licensee:

(i) Name:

(ii) Address (residential)

(iii) Tele: (office)

(iv)

Tele:

(mobile)

(v) E-mail id:

2. Whether digital

signature has

been

obtained by the warehouse keeper (as per guidance available on ICEGATE website)?

3. Has

the IT

based record

keeping requirement

been

fulfilled by the Licensee?

4. Details

as per regulation 4 of

Private Warehouse Licensing Regulations, 2016:

(i) Insurance Policy

(ii)

Undertaking under section

73A (iii) Indemnity undertaking

5. Whether specimen

seal,

signature, and contact details of the authorized signatories

have been submitted?

6. Licence

No.:

7. Warehouse Registration Code on

ICEGATE:

8. Date

of operationalization of the

warehouse:

Signature:

Name:

Designation:

Date:

Part V

(For use by Customs

only)

1. Date

of verification

visit to certify commencement of

manufacture or

other operations in the

Warehouse:

2. Name

of the officials who

visited the premises:

3. VERIFICATION REPORT:

(i) I have verified that the unit has commenced manufacture or other

operations.

(ii) I

have verified that records are being maintained by the licensee as prescribed under

Annexure B of Circular 38

/2018-Customs dated 18.10.2018

Signature:

Name:

Designation:

Date:

Annexure-C

General

Bond

(To be

executed under sub-section (2) of Section 59 of the

Customs Act,

1962 by

a unit operating under section 65 of the

Customs

Act1962)

KNOW ALL MEN

BY THESE PRESENTS THAT

we

M/s _____ having our

office located at _____

and holding Import –Export

Code No. _____ , hereinafter

referred to

as the “importer”, (which expression shall include

our successors, heirs, executors, administrators and legal representatives) hereby jointly and severally bind ourselves to the President of India

hereinafter referred to as the “President” (which expression shall include

his successors and

assigns) in the sum of Rs _____ (please fill amount in words) to

be paid to the President,

for which payment well and truly

to be made, we bind ourselves, our

successors,

heirs,

executors, administrators and

legal representatives

firmly by these presents.

Sealed with our seal(s) this _____ day of

_____ 20

_____.

WHEREAS

the Principal Commissioner or Commissioner of Customs, has granted license to operate a warehouse under

Section

58 of the Customs Act;

AND WHEREAS the Principal Commissioner or Commissioner of Customs, has granted permission for carrying out manufacture and other operations in the warehouse under Section 65 of

the Customs Act

vide

letter dated _____;

AND WHEREAS the Assistant/ Deputy

Commissioner of Customs has given permission to

enter into a General Bond for

the purpose of sub-section (2)

of Section 59 of the Customs Act, in respect of warehousing

of goods to be imported

by

us during the period from _________ to _______ (both days

inclusive).

NOW THE CONDITIONS of

the above written

bond is such that, if we:

(1) comply

with all the provisions of the Customs Act, 1962, Central Goods and Services

Tax

Act, 2017 or Integrated

Goods and Services Tax Act, 2017 or Goods and Services Tax (Compensation

to States) Act, 2017 and the rules and regulations made

thereunder in respect of such goods;

(2) pay in the event of our failure to discharge our obligation, the full amount of duty

chargeable

on account of

such goods together

with their interest, fine and penalties payable

under section 72 of the Customs

Act,

1962 in respect of such goods;

(3) pay all penalties and fines incurred for contravention of the provisions of the Customs

Act, 1962, Central Goods and

Services Tax

Act,

2017 or Integrated

Goods and Services Tax Act, 2017 or Goods and Services Tax (Compensation to States) Act,

2017 and the rules or regulations made thereunder,

in respect of such goods;

Then

the above written bond shall be

void and of no effect; otherwise the

same

shall remain in

full force and virtue.

IT IS HEREBY AGREED AND DECLARED

that:

(1) the Bond shall continue in full force notwithstanding the transfer of goods to any other

premises

for job work;

(2) the President through the Deputy/Assistant Commissioner of Customs or any other officer may

recover any amount due under this Bond in the manner laid down under

sub-section (1) of section 142 of Customs Act, 1962, without prejudice to any

other mode of recovery.

IN THE WITNESS WHEREOF, the importer has herein, set and subscribed his hands and seals

the

day, month and

year first above written.

SIGNED

AND

DELIVERED by or on

behalf of the importer

at _____

(place) in the presence of:

(Signature(s) of

the importer/authorised signatory)

Witness:

Name and Signature Address Occupation

1.

2.

Accepted

by

me this![]() day of

_____ 20

_____, for and on behalf of the President of

India.

day of

_____ 20

_____, for and on behalf of the President of

India.

(Assistant/Deputy Commissioner)

Signature and date

Name:

Schedule to the General Bond to be executed by the importer under

sub-section (2) of Section 59 of the

Customs Act,

1962 for the purpose of warehousing of goods to

be imported by them.

|

Bill (Warehousing/ Home

consumption/

Export)

No.

and

date |

Duty assessed

on the goods |

Bond value

to be debited or

credited (Thrice the amount of

duty) |

Debit |

Credit |

Balance of bond

value |

Remarks |

Signature

of the officer along

with full name and designation |

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

|

|

|

|

|

|

|

|

|